We'll make it as smooth as possible

Our mission is to create better. To continue pushing beyond what has gone before. To build a company whose purpose is to help transform neighborhoods and the way we live through considered, intelligent and unexpected design.

Start your journey here

Our network of luxury real estate agents provides unrivaled access to distinctive properties around the world. To represent a home of distinction requires highly-qualified real estate professionals with global reach and local expertise. Always inviting, discreet, savvy and refined, our luxury real estate brokers artfully unite extraordinary properties with extraordinary lives.

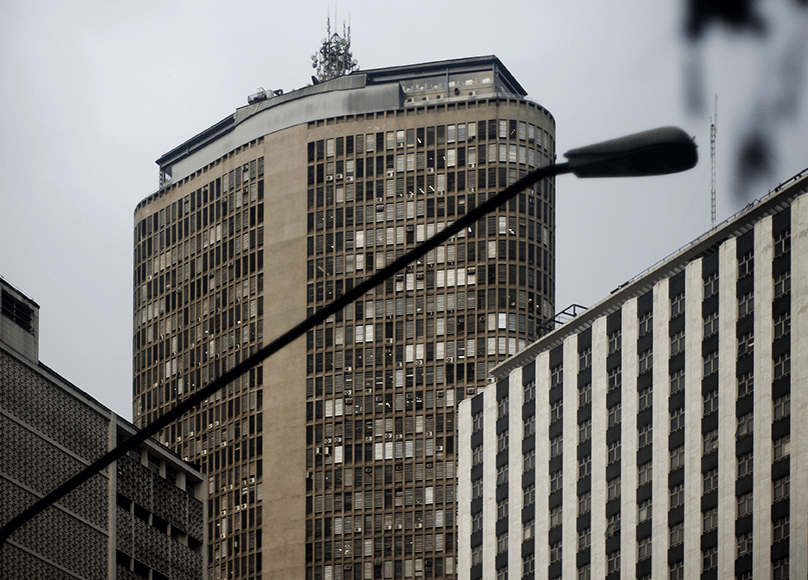

Check out some of our projects

The quality and value are important to us because we know how important they are to you.

Facts about us

352

Approved projects

120

Returning customers

17

Award nomination

23

Years of experience